Feed Aggregator Page 590

Rendered on Thu, 12 Jan 2017 20:30:08 GMT

Rendered on Thu, 12 Jan 2017 20:30:08 GMT

via by Tyler Durden on Thu, 12 Jan 2017 20:07:50 GMT

Not satisified with demands for banning cash in America, Harvard economics professor Ken Rogoff has lashed out at critics of negative interest rates, calling them "ignorant" in their analysis of the unprecedented measures.

As a reminder of Rogoff's recent proclamations, according to the esteemed ivory tower academic, paper currency lies at the heart of some of today’s most intractable public-finance and monetary problems. As Rogoff explains in The Wall Street Journal, getting rid of most of it - that is, moving to a society where cash is used less frequently and mainly for small transactions - could be a big help.

Rogoff's begins by stating factoids as facts...

There is little debate among law-enforcement agencies that paper currency, especially large notes such as the U.S. $100 bill, facilitates crime: racketeering, extortion, money laundering, drug and human trafficking, the corruption of public officials, not to mention terrorism. There are substitutes for cash—cryptocurrencies, uncut diamonds, gold coins, prepaid cards—but for many kinds of criminal transactions, cash is still king. It delivers absolute anonymity, portability, liquidity and near-universal acceptance. It is no accident that whenever there is a big-time drug bust, the authorities typically find wads of cash.

Cash is also deeply implicated in tax evasion, which costs the federal government some $500 billion a year in revenue. According to the Internal Revenue Service, a lot of the action is concentrated in small cash-intensive businesses, where it is difficult to verify sales and the self-reporting of income. By contrast, businesses that take payments mostly by check, bank card or electronic transfer know that it is much easier for tax authorities to catch them dissembling. Though the data are much thinner for state and local governments, they too surely lose big-time from tax evasion, perhaps as much as $200 billion a year.

Cash also lies at the core of the illegal immigration problem in the U.S. If American employers couldn’t so easily pay illegal workers off the books in cash, the lure of jobs would abate, and the flow of illegal immigrants would shrink drastically. Needless to say, phasing out most cash would be a far more humane and sensible way of discouraging illegal immigration than constructing a giant wall.

So to clarify - Cash (and Donald Trump) are at the center of all of America's and the world's ills and therefore - as a PhD who knows best - we must destroy it (for your own good).

And now, as Bloomberg reports, anyone who questions this, or the imposition of negative interest rates (or a tax on cash) by central banks is "ignorant."

It’s impossible to analyze the effects of the “early experiment” with negative rates because central banks were left to themselves amid a global fiscal retrenchment, Rogoff, a professor at Harvard University, said Wednesday in an interview after speaking at the Skagen Funds annual conference in Oslo.

“I find a lot of what is written by representatives of the financial sector, they’re very hostile to negative rates, to be kind of ignorant,” he said ahead of a tour of Scandinavia, where sub-zero rates first saw the light of day. “They’re talking about their short-term profits, and their short-term interest, but it’s a long-run policy if you do the homework, if you lay the groundwork, it would certainly work very well.”

Those questioning the efficacy of the policy got more rhetorical ammunition this week when a report showed inflation in Denmark, where rates have been negative for almost half a decade, was the lowest in 63 years in 2016.

According to Rogoff, it’s impossible to draw any conclusions because the efforts to restore growth and inflation have been one-sided.

But done “correctly” it can restore “complete control over inflation expectations,” he said.

Of course, if you do not agree with this 'elite' Davos-Man, then you probably don't deserve to vote either.

via by Tyler Durden on Thu, 12 Jan 2017 19:49:19 GMT

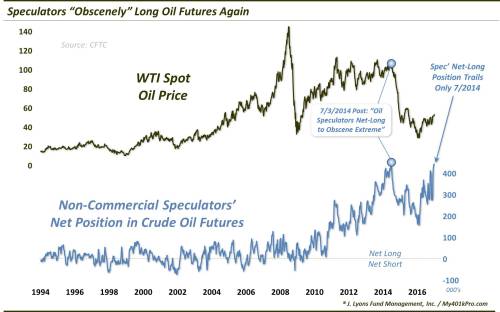

Speculators in crude oil futures are back near their “obscene” record net-long position set just prior to the 2014 collapse in oil prices.

When we started posting our charts on social media and writing this blog some three years ago, one of the most popular early posts dealt with trader positioning in crude oil futures. That was at the beginning of July 2014, and to this day it remains one of our most popular posts. The title of the post was “Large Speculators Net-Long To Obscene Extreme”. And to look at the chart was to instantly understand the impetus behind the title.

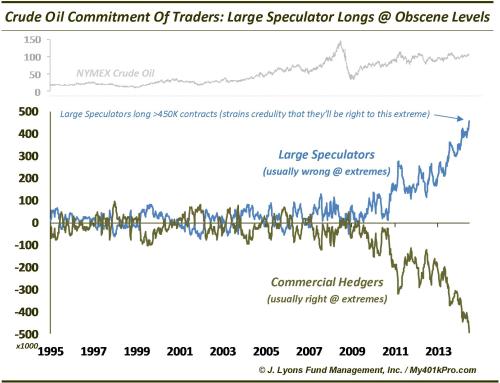

Chart from July 3, 2014 post:

At the time, the trajectory of the record net-long position in crude oil futures by Non-Commercial Speculators (and by extension, the record net-short position by Commercial Hedgers) had gone fully parabolic. In the case of the Speculators, prior to 2013, their largest ever net-long position in crude oil futures was 276,000 contracts, and prior to 2011, the record was 176,000 contracts. At the end of June 2014, their net-long position was a record-smashing 459,000 contracts. On the flip side, Hedgers’ net-short position had grown to a record 492,000 contracts.

Why was that important? As we have explained on many occasions in these pages, this data from the CFTC’s Commitment Of Traders (COT) report provides a very useful look at the positioning of various groups of traders. The 2 biggest groups are Non-Commercial Speculators and Commercial Hedgers:

Given the above primer, the Speculators’ record long position back in early July 2014 naturally had us concerned about a potentially significant drop in oil. Should oil prices begin to turn down, the record long Speculator position represented a massive amount of money at risk of exiting the market.

However, the fact that the positioning was so skewed, far beyond any levels previously seen, we wondered if there was something that had structurally changed in the market. This was a source of great debate at the time, even among our firm. From the 2014 post:

Is this extreme positioning a sign that oil prices are about to nosedive? We’re not so sure. Oil prices, while at the upper end of the range of the past few years, have not experienced a rise anywhere commensurate with the rise in Large Specs’ long positioning. Therefore, perhaps there is a structural change in the data that we are not aware of. We do know that long-only commodity funds and ETF’s may be distorting the COT figures a bit. Regardless, on a short-term momentum and rate-of-change basis, the data still appears relevant. And based on those metrics, Large Spec positions are elevated to an extreme.

The one catch regarding the structural change argument is that we don’t observe the same behavior in other futures’ COT data. If, for example, long-only funds were distorting the net-long positioning of Large Speculators, we would expect to see the same types of extreme COT readings across other futures contracts that we see in Crude. That is not the case. Therefore, it is possible that Large Specs, aside from some structural change, really are extremely off-sides to the long side of crude. That would be a foreboding sign for the price of oil. While it is close to breaking out above 3-year highs, we would be on the lookout for a failed breakout if a new high does materialize. Given their historical track record at extremes, Large Speculators are not likely to be big beneficiaries in the long-run from an impending rise in crude prices.

Thus, while we were open to the possibility of a structural shift in the data, our hunch was that Speculators were indeed overloaded to the bullish side of the boat. As we wrote on the chart, “it strains credulity that they will be right to that extreme”. As luck would have it, oil prices topped out that very week. They would go on to drop 50% by the end of the year, and 75% by early 2016.

We say “luck” because, in actuality, we could have posted a chart of record Speculator net-long positions at several points during the previous 3 years. It just wasn’t until June-July 2014 that it mattered. Thus, identifying an extreme is not difficult – identifying when it will make a difference is. So, it was certainly a bit of luck that we posted that chart when we did, “calling” the top in oil.

We bring up this episode and lesson now because of our present circumstances. Specifically, after a substantial unwinding of the Speculators’ long position during the July 2014-2016 rout in oil prices, the bounce in oil over the past 12 months has seen them rebuild their position. And as of last week, they were net-long over 440,000 contracts, 2nd only to June-July 2014.

Will this “obscene” net-long position result in the severe headwind for oil prices as it did last time? Again, we can see that the position is extreme, but we don’t know when that extreme will hit the tipping point. The Speculators’ net-long position could continue getting more extreme, indefinitely. However, we will say that these are not the conditions that oil bulls want to see when considering the prospects for another sustainable run higher.

We can’t predict for sure when the next shoe will drop in the oil market. These Speculators may continue to be correct in their bullish posture for awhile. However, given their obscene position, you can bet that eventually they’re going to get lit up again.

* * *

More from Dana Lyons, JLFMI and My401kPro.

via Motley Fool Headlines by on Thu, 12 Jan 2017 19:52:00 GMT

Do you see what happens when you neglect the Mac? Do you see what happens?via Motley Fool Headlines by on Thu, 12 Jan 2017 19:49:00 GMT

The Canadian oil pipeline giant has already signaled that its dividend will rise in 2017, which it backs up with strong financials and a visible growth backlog.via Motley Fool Headlines by on Thu, 12 Jan 2017 19:40:00 GMT

Activism was so-so, there were no BDC failures, and BDCs haven’t won the right to higher leverage.via Motley Fool Headlines by on Thu, 12 Jan 2017 19:40:00 GMT

Excitement around buyout attempts proved to be a distraction from Hershey's growth slowdown.via by Tyler Durden on Thu, 12 Jan 2017 19:28:11 GMT

"After a Jan/Feb wobble, we believe stocks & commodities will have one last 10% meltup in H1," explains BofA's Michael Hartnett in his latest note, but, he adds, by the end of 2017 we will see a "meltdown." BofA awaits the endgame of the so-called "Icarus Trade" amid unambiguous signs of bullish investor Positioning, bullish Profit expectations & hawkish Policy from Fed/ECB, as well as outperformance from laggard risk assets; before calling for the Big Short.

Our tactical view: after a Jan/Feb wobble, we believe stocks & commodities will have one last 10% melt-up in H1. Call it the “Icarus trade”. The current melt up, which started back in Feb 2016, will be followed by a meltdown later in ’17.

The current rally started in Feb 2016 with...

Thus the rally is likely to end with...

Are we there yet? No.

Sure, you can get a wobble in coming weeks. Investors are partial to the “buy the election, sell the inauguration” argument. Fed anxiety could pick-up between the two winter FOMC meetings: Feb 1st & March 15th, especially given December surge in US wage growth. And Trump/Mexico/China headlines/tweets have the ability to rattle sentiment as the new President seeks to immediately boost his ratings via populist trade policies & legislation (…from Occupy Wall Street to Occupy Detroit or Occupy Silicon Valley).

But we don’t see Positioning, Policy & Profit arguments for a big Q1 correction. The conventional wisdom has flipped from “Davos Man” portfolios to “Joe Six-Pack” portfolios in recent quarters. But let’s not forget the extremity of the starting point of this Great Rotation: global interest rates were at 5,000 year lows in Jul’16 and this induced acute dislocations in asset/sector/regional valuations...

Thus we should expect the ongoing rotation out of entrenched Wall Street to Main Street (Table 1) assets to be violent, extreme, and ultimately overshoot.

The core Wall Street to Main Street trade remains long banks, short bonds. A few laggard risk trades:

The contrarian should be tempted by EM assets, but they remain hampered by China’s currency devaluation. China’s currency is likely to remain under pressure due to capital outflows & deteriorating rate differentials with the US. When Asian currencies depreciate (the renminbi is the largest component of the Asia Dollar Index “ADXY” which is currently close to its 2008 lows), EM underperforms (Chart 4).

Finally, in term of 2017 tactics, the signals that the Big Top in risk assets is approaching in coming quarters will likely be fatigue in high yield & US banks, a contrarian rally in gold, and rates volatility as the era of excess liquidity reverses.

via by Tyler Durden on Thu, 12 Jan 2017 19:05:00 GMT

Submitted by Charles Hugh-Smith via OfTwoMinds blog,

What's progressive? Pushing power, agency, skills, capital and solutions down to the individual, household, community, enterprise, town and city levels and focusing on doing more with much less.

We know what fake-Progressives support: neocon-neoliberal policies and narratives that enable elite privilege, power and Imperial pretensions.

So what's truly progressive? We can start with four things:

1. Focus on developing skills that build capital, not on issuing costly credentials controlled by cartels.

2. Accept that borrowing from future generations to pay today's expenses is morally and financially bankrupt.

3. Fix healthcare by integrating medicine with the causes of illness-- lifestyle, diet, fitness, agency and culture--and decentralized programs of prevention.

4. Accept that "growth" of consumption, debt, GDP, etc. is no longer the solution, it's the problem: Degrowth is the solution.

Focusing on issuing more credentials fails students and enriches the institutions that monopolize the credentials. As I explain in my book The Nearly Free University and the Emerging Economy, the solution is to accredit the student, not the school.

Education that actually has value in the emerging economy is based not on jumping through hoops at enormous expense to obtain a credential, but on acquiring the skills and values needed to build capital in all its forms.

Issuing a student another credential doesn't magically lift them out of poverty; to escape poverty, people need a wealth of real-world skills and the set of soft-skills/values I call the eight essential skills in my book Get a Job, Build a Real Career and Defy a Bewildering Economy.

Accrediting the student rather than the institution will require upending the costly bureaucracy of higher education, radically reducing costs while radically improving outcomes.

Take a look at this chart of federally funded debt-serfdom, i.e. student loans, and explain what is remotely progressive about debt-serfdom in service of credentials with marginal market value.

And while we're looking at debt, look at the trajectory of federal debt and ask yourself: "does this look healthy or sustainable?" The answer is obviously no; this trajectory leads to fiscal bankruptcy, and it is morally bankrupt to burden future generations to pay today's bloated, wasteful expenses just to maintain the status quo.

It is insane to encourage an unhealthy lifestyle and then wonder why the costs of treating the illnesses we've generated are skyrocketing. The obvious solution is to look at health as an ecosystem of inputs and dynamics that interact in predictable ways. If we put garbage in, we get garbage (poor health) out. In essence, the current system relieves the participants ("patients") of the responsibility to be part of the solution, and offers few ways for people to participate in regaining their health.

The solutions are visible, but they're not profitable to the status quo, so we get a system that is more expensive than any other on Earth while yielding subpar outcomes.

"Growth" as the solution to every problem may have worked in 1945, but runaway "growth" of debt-funded consumption was do-able when resources were abundant, the population of high-consumption humans was lower and debt was modest. None of those apply today.

The only solution going forward is Degrowth: doing more with much less. The only way to manage this progress is to decentralize the power and control; centralization, like "growth," is itself the problem, not the solution.

I lay out how to structure a global network of community economies geared to doing more with much less in my book A Radically Beneficial World: Automation, Technology and Creating Jobs for All.

What's progressive? Pushing power, agency, skills, capital and solutions down to the individual, household, community, enterprise, town and city levels and focusing on doing more with much less. This requires completely disrupting the debt-based, wasteful, centralized, privilege-protecting status quo.

via Motley Fool Headlines by on Thu, 12 Jan 2017 19:05:00 GMT

Is the cloud platform provider a worthy buy at 10 times its trailing revenue?via by Tyler Durden on Thu, 12 Jan 2017 18:46:57 GMT

Today the Fed released the full set of transcripts from its eight 2011 meetings, a year which was particularly tumultuous due to the end of QE2, the downgrade of the US AAA rating by S&P, and the peak of the European debt crisis. It was also the first year in which the Fed's hope of hiking rates "soon" was crushed as global deflation returned, eventually forcing the Fed to launch Project Twist and QE3.

As has become a tradition, instead of breaking down the specific transcripts - readers can do so at their leisure here - we summarize the prevailing mood at each meeting based on the number of instances of "laughter" revealed in the transcript. As shown in the chart below, 2011 was decidedly more funny than 2010, if only to the FOMC, which laughed on average 39.4 times every meeting, up 43% from the 27.4 times per meeting in 2010.

Furthermore, as some have suggested, the Fed's forced laughter was an indication of underlying tension, which means that while August was the most uneventful meeting, the November meeting was by far the most tense, as FOMC members laughed at least 57 times, which would make intuitive sense: this is the meeting that preceded the global Fed bailout of the European financial system with the launch of trillions in currency swaps.

Which is why we decided to focus particularly on this specific meeting, and while much of the discussion involved, as one would expect, the collapsing European financial situation and US monetary conditions - a rather interesting debate on the use of negative rates in the US can be found in the September transcript - what we found most interesting was the Fed's real-time analysis and "hot takes" of the MF Global bankruptcy which took place on October 31, 2011 and combined a variety of issues: from being a Primary Dealer, to its holdings of Italian bonds which plunged in value, to its flawed capital structure, to the "hubris" of its principals.

The first mention of MF Global in the November 1-2 meeting, or just days after the bankruptcy took place, was in Brian Sack's summary of recent events, in which he explains how the Fed, despite having substantial exposure to the failed primary dealer, managed to avoid losses, as follows:

As you know, MF Global experienced a rapid deterioration that led the firm, and the U.S. broker–dealer subsidiary that is a primary dealer, into bankruptcy. In short, investors became skeptical about the viability of the firm given the size of its exposures to European sovereign debt markets, its weak earnings for the third quarter, and the associated downgrades of the firm by several rating agencies. With these events, the firm found itself unable to sustain sufficient financing, even as it attempted to rapidly sell parts of its business and shed assets.

The path of MF Global serves as an example of the vulnerability of firms that are heavily reliant on short-term wholesale funding. As shown in the bottom-right panel, the firm had a narrow equity buffer, and its liability structure was relatively unstable. Indeed, the firm had little longer-term unsecured debt and, since it was not a bank, no retail deposits. Instead, the firm had 61 percent of its liabilities in the form of repo transactions and other trading liabilities.

This structure left the firm very susceptible to a liquidity run in response to any emerging questions about its capital adequacy. Of course, this is the same issue that I noted earlier in the discussion of investor concerns about Morgan Stanley and Goldman Sachs. However, as can be seen in the table, Morgan Stanley has a much larger share of long-term debt as well as some retail deposits. The table also shows the figures for JP Morgan to offer a comparison to an institution with a larger banking operation.

The problems experienced by MF Global raised risks to the Federal Reserve through our counterparty relationship with the firm. Our potential exposures were associated with MF Global’s participation in our securities lending operations, in our operations in Treasury securities, and in our operations in agency mortgage-backed securities. The Desk began to exclude MF Global from some operations last Wednesday and from all operations last Thursday. Yesterday, the Federal Reserve Bank of New York announced that it had terminated its primary dealer relationship with MF Global.

Heading into the market open yesterday, our only exposure to the firm was from seven unsettled MBS purchase transactions. These transactions, which totaled about $950 million, were due to settle as far out as mid-January. To limit the risk to the Federal Reserve from these transactions, on Friday we established a special arrangement for the firm to post collateral to us on a daily basis. Based on yesterday’s events, we exercised our legal authority to terminate the seven trades, and we conducted trades with other counterparties to reestablish the same positions, using the collateral that had been posted by MF Global to cover the additional expense of those replacement trades. Given these steps, we do not expect to realize any losses from our counterparty exposures to MF Global.

This then led to an informal discussion between the FOMC members on MF Globa, starting with Richard Fisher, where the topic of customer account commingling and rehypothecation first emerges. As Brian Sack admits, "if there were problems in that regard, you could see a loss in confidence in other types of custodial arrangements or intermediaries."

MR. FISHER. First, I want to congratulate you on handling MF Global the way you handled it. I have a question about that, and I have two other questions. But on this front, any other trip bars that might ensue from MF’s failure that you’re monitoring in terms of its impact on the system—not the Federal Reserve System, but on the fixed-income markets and on financial stability?

MR. SACK. Yes, there are several areas we’re monitoring. MF Global, of course, had essentially a large brokerage unit into futures markets. One area we’re watching is whether their customers will experience any period of disruption and confusion about their ability to change positions. There could potentially be odd short-term dynamics for futures markets.

The second area is questions about whether the customers’ assets are truly fully there at the institution, and if there were problems in that regard, you could see a loss in confidence in other types of custodial arrangements or intermediaries.

And the third area is whether there would be any consequences for repo financing, not necessarily direct consequences associated with the unwinding of MF Global’s positions, but broader concerns about whether repo funding for less liquid assets is as stable as the market had assumed.

I’m sure there are others, but those are three areas that we’re watching. Not having the benefit of seeing markets today, but through yesterday, it looked like the markets were not overly concerned with any of those systemic consequences, but that’s what we’ll continue to monitor

Next, its was NY Fed president and former Goldmanite (and therefore subordinate of former Goldman head and then-MF Global CEO Jon Corzine) Bill Dudley's turn to chime in.

VICE CHAIRMAN DUDLEY. Yes, just a few things. This is the first significantly sized FCM, futures commission merchant, that’s failed in a way that they didn’t actually port the customer accounts off smoothly to some other entity. There’s a little bit more uncertainty here because it has never happened like this before. In the past, there has always been a smooth transfer of accounts.

The second thing I would say is that it underscores how fast liquidity can dry up for a firm. This is another firm that, while I wouldn’t say they were fine a week ago, they didn’t look like they were headed to collapse, and a week later they’re dead. That is going to reinforce people’s anxiety about firms that are wholesale funded without any obvious lender-of-last-resort support from the central bank. I think as long as other firms stay out of trouble, it’s not an issue, but if they get into trouble, people may actually pull back faster as a consequence.

And the third thing, of course, is that this was triggered in part by, as Brian mentioned, European sovereign debt exposure. To the extent that things in Europe deteriorate, other firms are viewed as having exposure to Europe, and that’s another aspect of this. But so far we would say, and I think Brian and I would both agree, that the selloff in the market today really has very little to do with MF Global.

Former FOMC staffer Elizabeth Duke then touched on the issue what would happen to MF Global's derivative counterparties:

MS. DUKE. My question goes back to the impact on customers of MF Global, and this question may not make sense because I wasn’t sure I understood the article I read just before I came in here. But it was something about either clearinghouses or exchanges freezing customer transactions, customers of MF. And then, I was remembering how some of the people who came through here were really unhappy in the Lehman bankruptcy about their collateral getting tied up in pieces. Is there anything in moving derivatives to central counterparties that we should be aware of in connection with this?

MR. SACK. That is related to one of the three broad concerns I talked about: Would there be uncertainty about the client’s ability to change positions? Would there be confusion about what the status of their assets was or not? And as Vice Chairman Dudley mentioned, without the quick transfer of the client accounts, it leaves this uncertainty. I don’t know enough about the legal arrangements to answer the questions you raise. But how long that will take and how transparent it will be in terms of when the customers will be able to reaccess their positions is one of the big areas of uncertainty here.

Outgoing Fed president Dennis Lockhart then asked Brian Sack what the MF Global bankruptcy means for financial instability, in light of recent bank "runs" at Morgan Stanley and Goldman Sachs:

MR. LOCKHART. Thank you, Mr. Chairman. Just to continue on the question of MF Global, a couple of weeks ago, as you see on chart 12, there was—and I hesitate to call it a “run” —but certainly a lot of pressure on Morgan Stanley and Goldman Sachs, which has eased. Then, we get the first casualty with MF Global. My broad question, Brian, is: Are you more or less concerned about financial instability now than two weeks ago? How is that trending?

MR. SACK. At best slightly more comfortable, but actually probably about the same. As I noted, what happened a few weeks ago with Morgan Stanley and Goldman Sachs was the same dynamic. Taking Morgan Stanley as an example, based on their discussions about the firm’s exposures, I think market participants weren’t convinced that the firm actually had problematic exposures, but what they were convinced about was the fact that if the market got too concerned, they could put Morgan Stanley out of business because of their reliance on short-term funding markets. I think that contributed a lot to the jitters that emerged in early October, and it is the same dynamic that ultimately brought down MF Global. But I do want to emphasize that MF Global is a very different case than a Morgan Stanley, in terms of the aggressiveness—relative to its size—of how MF Global was positioned.

Dudley then chimed in with am ominous warning: "The MF Global experience showed you that whatever liquidity cushion you have can run off a lot faster than you expect."

VICE CHAIRMAN DUDLEY. Morgan Stanley, we believe, has a very large liquidity cushion. The MF Global experience showed you that whatever liquidity cushion you have can run off a lot faster than you expect. Morgan Stanley is starting with a much better balance sheet than MF Global was, and they have been actually earning money. One of the precipitating events for MF Global was that they took a very large loss in the most recent quarter. That was really what started this thing spinning last Tuesday.

Lesson learned: never take large losses. That said, Lockhart had some follow up questions, namely whether MF Global was taken down by "predatory market players" to which the former head of the Fed's trading desk said "No."

MR. LOCKHART. Do you see any dynamic of predatory market players essentially gaining any victory with this one and moving on to the next most vulnerable?

MR. SACK. No.

MR. LOCKHART. No, we don’t see anything like that?

VICE CHAIRMAN DUDLEY. I don’t think this was about people shorting the CDS and driving down the stock price. This is all about the fundamentals of the company; that would be my opinion.

Some, like Jim Bullard was confused why a primary dealer imploded in such spectacular fashion. The answer: "They passed the credit review. But that doesn’t guarantee that they can’t go downhill. As we see in the market price and everything, they went downhill very quickly and very unexpectedly."

MR. BULLARD. Thank you, Mr. Chairman. On MF Global—it became a primary dealer this year, is that correct?

bRight.

MR. BULLARD. Are we happy with our expanded criteria for primary dealers? And does this give you any pause about that new, more expansive definition?

MR. SACK. The new primary dealer policy just increases the transparency about the requirements. There was no reduction in the requirements to be a primary dealer. When we look at the primary dealers as candidates, there is an extensive review. It covers quality of management, the quality of their systems, their financial health, and so on. But we are at a disadvantage. We are not a supervisor of this firm. There is a credit review. They passed the credit review. But that doesn’t guarantee that they can’t go downhill. As we see in the market price and everything, they went downhill very quickly and very unexpectedly.

Jeff Lacker also had a question whether and just MF GLobal was insolvent:

MR. LACKER. Yes, a question about MF Global, and then I want to follow up on a question from President Fisher. MF Global is insolvent, I take it? Is that our best information?

VICE CHAIRMAN DUDLEY. I don’t think we know whether they are insolvent or not. We know they can’t meet their obligations, but that doesn’t mean when they are all liquidated that the value of the assets couldn’t be a lot greater than the value of the liabilities. We don’t know that. The fact is that their long-term debt, which they have a small piece of, is trading at about, last time I saw, in the 35 to 45 percent per dollar range, which suggests that the market thinks that they are most likely to be insolvent. But we are not going to know for a while.

MR. LACKER. Okay. Do you view how it has played out as inefficient ex post?

VICE CHAIRMAN DUDLEY. It was inefficient in the sense that there was not an orderly bankruptcy process. It would be much better if there had been a way to move the customer accounts to new firms, so that they didn’t get trapped. It was messier than optimal. Is it systemic or not? Fingers crossed, we hope not.

Yes, that's the Fed expressing hope that "fingers crossed" the "messier than optimal" collapse of MF Global is not systemic.

Finally, we go back to Richard Fisher who chimed in, and slammed Dudley's former boss saying the MF Global "principals involved here were extremely arrogant, taking the positions that they had, and were imbalanced in terms of their judiciousness of risks, and I think the markets are well aware of that."

MR. FISHER. I would add a fourth factor, which is humility versus arrogance and balanced risk. The principals involved here were extremely arrogant, taking the positions that they had, and were imbalanced in terms of their judiciousness of risks, and I think the markets are well aware of that.

As to why Jon Corzine would be "extremely arrogant"? We have an idea...

Source: Federal Reserve

via Motley Fool Headlines by on Thu, 12 Jan 2017 18:57:00 GMT

The apparel retailer recovered from a slide in 2015, but results were mixed.via Motley Fool Headlines by on Thu, 12 Jan 2017 18:33:00 GMT

It's a technological shift that's primarily focused on the enterprise market -- and it's already here.via by Tyler Durden on Thu, 12 Jan 2017 18:22:20 GMT

The Justice Department Inspector General has launched a review of the actions of the Federal Bureau of Investigations and Department of Justice leading up to the 2016 presidential election.

The review will include FBI Director James Comey's news conference in July and his two letters to the Hill in late October and early November.

Before the Nov. 8 election, Comey sent a letter to lawmakers that said the FBI discovered new emails related to Clinton.

They were found as part of an on-going probe of disgraced former New York congressman Anthony Weiner.

The FBI later said it would not change its conclusion.

Department of Justice Inspector General Michael E. Horowitz announced today that:

In response to requests from numerous Chairmen and Ranking Members of Congressional oversight committees, various organizations, and members of the public, the Office of the Inspector General (OIG) will initiate a review of allegations regarding certain actions by the Department of Justice (Department) and the Federal Bureau of Investigation (FBI) in advance of the 2016 election.

Cognizant of the scope of the OIG's jurisdiction under Section 8E of the Inspector General Act, the review will examine the following issues:

- Allegations that Department or FBI policies or procedures were not followed in connection with, or in actions leading up to or related to, the FBI Director's public announcement on July 5, 2016, and the Director's letters to Congress on October 28 and November 6, 201, and that certain underlying investigative decisions were based on improper considerations;

- Allegations the FBI Deputy Director should have been recused from participating in certain investigative matters;

- Allegations that the Department's Assistant Attorney General for Legislative Affairs improperly disclosed non-public information to the Clinton campaign and/or should have been recused from participating in certain matters;

- Allegations that Department and FBI employees improperly disclosed non-public information; and

- Allegations that decisions regarding the timing of the FBI's release of certain Freedom of Information Act (FOIA) documents on October 30 and November 1, 2016, and the use of a Twitter account to publicize same, were influenced by improper considerations.

The review will not substitute the OIG's judgment for the judgments made by the FBI or the Department regarding the substantive merits of investigative or prosecutive decisions.

Finally, if circumstances warrant, the OIG will consider including other issues that may arise during the course of the review.

Is this the final action of a desperate-to-maintain-his-legacy Obama administration to ensure this topic never goes away and that blame for Hillary's loss is placed anywhere but on her and her campaign.

The White House has - obviously - denied any involvement in the decision:

via by Tyler Durden on Thu, 12 Jan 2017 18:12:28 GMT

If yesterday's 10Y Treasury reopening was "Yuuge", then today's 30 Year reopening of Cusip RU4 was just a little more subdued. Printing at 2.914%, it tailed the When Issued fractionally by 0.3bps, with the high yield coming well below December's 3.152%.

The internals hit or miss, with the Bid to Cover of 2.316 printing in line with the 12MMA of 2.303 if below last month's 2.392. This, however, was offset by strength in the Indirect takedown, which at 66.7% was the highest since last July, and above the 61.6% 12 month average. It confirms that foreign buyers, mostly central bankers, are very eager to reload on On The Run issues.

On the other hand, the Direct bidders were left with only 4.5% of the auction, the lowest since September 2009, which meant Dealers were let holding 28.8% of the auction.

In kneejerk reaction, there was some modest steepening in the curve as the long-end sold off on news of the tail, which in turn prompted a jump of about 20 pips in the USDJPY, which however is likely all due to trigger happy algos, and we doubt it will sustain itself as the auction was hardly poor.

via Motley Fool Headlines by on Thu, 12 Jan 2017 18:15:00 GMT

The pressure facing one of the largest solar companies in the world won't get any easier as 2017 unfolds.via Motley Fool Headlines by on Thu, 12 Jan 2017 18:05:00 GMT

The new year has brought an OPEC crude oil output reduction, and U.S. companies across the industry are already responding.via Motley Fool Headlines by on Thu, 12 Jan 2017 18:01:00 GMT

Instagram is launching full-screen ads on its hyper-engaged stories feature. Could this be the ad product Facebook needs to help it extend ad load growth?via by Tyler Durden on Thu, 12 Jan 2017 17:50:15 GMT

Earlier this morning, Kellyanne Conway appeared on Bloomberg to discuss Trump's economic policies regarding everything from job creation to tax cuts, energy investment, infrastructure spending, Obamacare and China. Of course, she started by taking the opportunity to boast about the "Trump Effect" that has already resulted in manufacturing jobs coming back to the United States and record high-er stock prices.

"First of all, you already see the Trump effect. You see that manufacturing jobs are already coming back to the U.S., or staying here. Plans to build factories in Mexico, to ship jobs over the border there, take them away from hardworking Americans have stopped. That's the Trump effect."

"You see that the stock market loves that fact that he was elected. We've had record highs over a number of days."

After the brief commercial introduction, Conway addressed Trump's plans to "roll back corrosive regulations" that have suffocated job creation, lower taxes across the board and work with companies to develop America's energy resources "in a responsible and profitable way for all of us."

"His job creation plan includes a number of things. First of all, it's just rolling back some of these corrosive regulations. We hear from business owners and aspiring business owners daily that it's the regulatory framework that is suffocating them."

"In addition, he has a very ambitious, very doable tax relief plan. He will create 25 million jobs over 10 years and he will reduce taxes across the board. Middle class tax relief. Those who don't pay taxes will have relief as well."

"Also in there is energy investment. This is something that we just haven't had in the past 8 years. We've been pretty hostile as a nation toward energy investment. You know what is made in America, our energy sources. It's under our feet and it's off our shores. And it's time we have Presidential leadership that will help develop it in a responsible and profitable way for all of us."

Conway also took aim at the Pharma industry saying "to repeal and replace Obamacare without having a conversation about drug pricing seems like not a reasonable prospect."

Asked whether Trump would declare China a currency manipulator on day one, Conway said that Trump "can be taken at his word" on the issue and intends to "be tougher on people around the globe who have not been called to account by this administration, and that would, of course, include China."

Finally, of course, Conway got to answer more questions about how the Trump organizations will be handled during his Presidency...something we're sure will be a non-stop focus for Elizabeth Warren, CNN and MSNBC for the next 4 years.

via Motley Fool Headlines by on Thu, 12 Jan 2017 17:57:00 GMT

The discount retailer surged on strong earnings growth to recover losses from 2015.via Motley Fool Headlines by on Thu, 12 Jan 2017 17:57:00 GMT

There's a big hit to earnings a-coming round the bend.