Feed Aggregator Page 607

Rendered on Sun, 15 Jan 2017 15:30:38 GMT

Rendered on Sun, 15 Jan 2017 15:30:38 GMT

via Motley Fool Headlines by on Sun, 15 Jan 2017 15:05:00 GMT

The reported numbers do not mean what you think they mean.via by Tyler Durden on Sun, 15 Jan 2017 14:53:29 GMT

We start our Sunday with some gloomy predictions from Morgan Stanley's appreciately named "Sunday Start" periodical, in which the bank's Chief Global cross-asset strategist, Andrew Sheets, explains why the market return under the Obama administration will be a tough act to follow. His argument in a nutshell: "good market environments often involve a shift from economic despair to optimism, and a shift in psychology from ‘fear’ to ‘greed’. Both occurred over the last eight years, producing returns well above the long-run average. Whichever party was next to take the White House, it was going to be a tough act to follow."

Which is not to say that MS is damning the "Trump market" before he has even stepped into office:

Things, of course, could get better, and we certainly hope that strong returns continue. But investors looking to keep the good times rolling should remember a key thing from the above: Starting points matter, making it logical to start with things that haven’t had a particularly good time over the last eight years.

The bank's advice: invest elsewhere, especially in places - like Europe and Japan - which have failed to enjoy the US asset bump, because as Morgan Stanley calculates, "non-US equities have underperformed the S&P 500 by 90% over the last eight years. In US dollars, they underperformed by 108%. Again, a better starting point, and a preference for Japan and European equities in 2017 remains a core view."

* * *

From Morgan Stanley's Andrew Sheets

A Tough Act to Follow

Next week’s inauguration of Donald Trump as US president will mean wall-to-wall discussion of what his policies mean for markets and the legacy of his predecessor. My colleagues will discuss the former in next week’s Start, and I am in no way qualified to comment on the latter. I’d like, instead, to discuss what unites both themes – that returns will likely do worse under the new administration than under the departing one, and where exceptions to this may be.

That statement may seem deeply unfair to an administration that hasn’t even had a chance to pass policy, and incongruous with the sharp rise in investor and business confidence in recent surveys. But it’s linked to a simple idea. Good market environments often involve a shift from economic despair to optimism, and a shift in psychology from ‘fear’ to ‘greed’. Both occurred over the last eight years, producing returns well above the long-run average. Whichever party was next to take the White House, it was going to be a tough act to follow.

And what an act it was. Eight years ago, stocks were in freefall, credit markets were frozen and a highly leveraged US banking system was struggling to avoid collapse. Car sales had fallen 50%, consumer confidence was at all-time lows and the housing market, the single biggest store of wealth in the United States, was witnessing foreclosure rates not seen since the Great Depression. Two foreign wars and falling tax revenues were pushing the budget deficit towards historical highs.

It was a troubling time. Market pricing, unsurprisingly, reflected that despair. The last time the market cared this much about what a new US president would do, the S&P 500 was at 805, high yield bonds yielded 18.1% and the VIX stood at 56%. Those same numbers today? 2257, 5.8% and 12%.

Those changed levels reflect a remarkably changed backdrop. Today, US car sales and consumer confidence are historically high, residential and commercial real estate prices are above prior cycle peaks and US banks are now trying to return capital, not raise it. US credit markets saw their highest-ever level of bond issuance (US$1.3 trillion) in 2016, jobless claims have hit a 40-year low and the budget deficit is back to the average seen since 1980. The S&P 500 equity risk premium was 5.8% in 2009, and now it stands at 1.4%. Returns under the outgoing administration, in short, enjoyed both cheap starting levels and a large rate of change. The incoming one may not have either.

Things, of course, could get better, and we certainly hope that strong returns continue. But investors looking to keep the good times rolling should remember a key thing from the above: Starting points matter, making it logical to start with things that haven’t had a particularly good time over the last eight years.

One is European Value. The sector has underperformed for 10 years, and has only just started to bounce. Our European equity strategists think it will be in the unusual position of combining low valuations with strong earnings growth in 2017, while remaining under-owned. More broadly, non-US equities have underperformed the S&P 500 by 90% over the last eight years. In US dollars, they underperformed by 108%. Again, a better starting point, and a preference for Japan and European equities in 2017 remains a core view.

via Motley Fool Headlines by on Sun, 15 Jan 2017 14:42:00 GMT

Less than one-fifth of American adults actively contribute to an IRA, but more people should definitely be taking advantage.via by Capitalist Exploits on Sun, 15 Jan 2017 14:22:04 GMT

Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing.

Welcome to this week’s edition of “World Out Of Whack” where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all its glorious insanity.

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the “World Out Of Whack” as your double thick armour plated side impact protection system in a financial world littered with drunk drivers.

Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live.

Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar – because, after all, we are capitalists.

In a previous edition of the WOW I wrote about a bubble in dumb money, and in it we looked at the massive drawdowns in capital from hedge funds in favour of "passive investing" via ETFs. Investors have a point. Why pay 2/20 when you can pay as little as 0.09% for an ETF which appears to do pretty much the same thing as a hedgie?

Two reasons that a 10-year old should be able to provide:

I summed my thoughts up with the following:

I fear we’re about to find out how smart “smart beta” really is. When the inevitable happens and Bob and Mabel, together with their millennial grandkids, Peach and Cloud, lose their shirts there’ll be no-one there to explain to them, “sorry, snowflake but did you realise that over half of the index you bought was sporting P/E and P/B ratios that have only existed a couple of times before?”

To help us along today in providing a granular view of how truly silly indexing really is I'm leaning on my buddy Harris Kupperman (Kuppy) who, after our discussions on the topic and some sifting through the entrails of ETFs, offered up the following:

So, this should be pretty easy to sort out.

Crawford & Co has two classes of stock, A and B. The A shares pay a dividend that is 2 cents a quarter higher than the B shares. There are differences in voting rights, but as there’s a control shareholder, those are irrelevant.

Therefore, a simple analysis says that the A shares ought to trade at a moderate premium to the B shares to account for the nearly 1% higher annual dividend yield. NOPE!! The B shares are in the Russell 2000 index and the B shares now trade at roughly a 35% premium to the A shares.

Now, I’m not here to pass judgement on the investment merits of Crawford and the A or B shares. I have done no analysis on the company and have no opinion on if it is a good investment or not. However, I know that the A shares are better than the B shares as you get a higher dividend and there is no logical reason for the B shares to trade at a huge premium except that the Russell 2000 index has to keep buying them as more money is allocated to the index.

Two years ago, I noted how index funds and ETFs were warping asset valuations and creating opportunities for those who were willing to seek them out.

This trend has only accelerated since then and has grown from something of a curiosity in certain asset classes into a true bubble that is doomed to eventually pop. There are now hordes of overvalued assets that have no justification for their overvaluation, except that index funds have to own them. Like all bubbles, this one too will burst.

In the interim, there will be huge opportunities created by how index funds misallocate capital. As I said earlier, I know nothing about Crawford, but if I wanted to own it, I sure as hell wouldn’t be buying the B shares when compared to the A shares. Additionally, I feel pretty confident in saying that at some point in my career, the A shares will trade at a premium to the B shares—as they deserve to.

At the same time, I wouldn’t be betting that this spread collapses any time soon either. Shorting indexing has been a widow-maker for many in the hedge fund industr y— it’s hard to fight against fund flows.

In finance, when a trend gets in motion and the marketers start pushing it (indexing and ETFs today) you can expect it to go further than is logically possible, but the hangover will be pretty epic. Along the way, there will be a lot of money made by better understanding the flaws in these indexes and front running them — much as I front-ran the marketing department back in March.

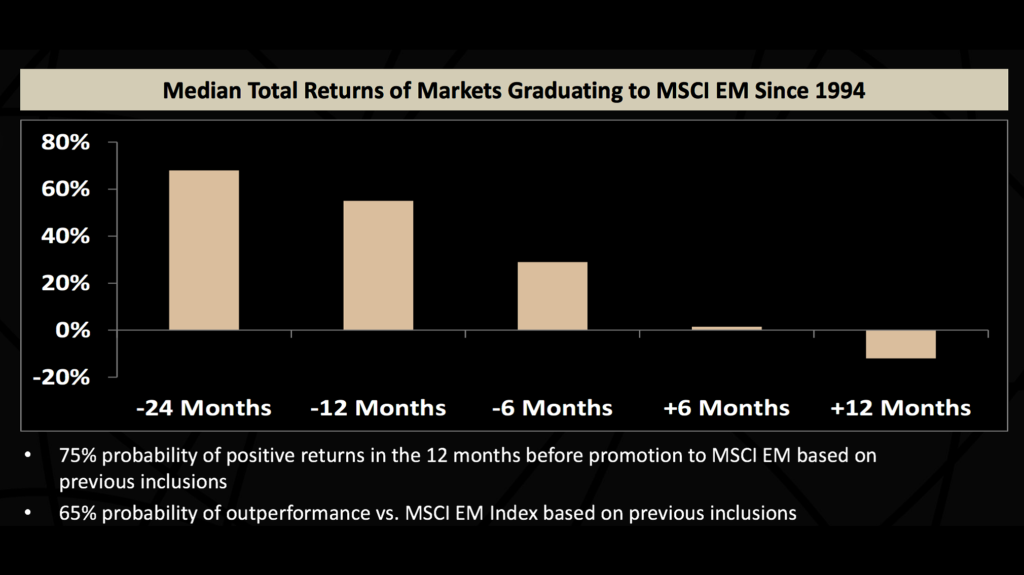

As a final note, I’d like to share a chart with you from Passport Capital showing the median total returns of markets graduating to the MSCI EM since 1994. If you can’t beat the indexers, you might as well make money off of them by getting there first.

I think it's probably worth going back to that article from 2 years ago because it shows exactly how we made money on similar anomalies.

Think of it this way, as the indexing movement has grown, so have the assets under management — leading index funds to become key factors in access to capital. You now have really bad companies that have overstated market valuations, simply because the index has to buy it — yet you have high quality companies that should get access to capital, but are starved because they are not in the index, or not in the index at an adequate weighting.

In the real world, we call this socialism—basically starving the strong in order to prop up the stragglers. In the investment world, this is called indexing.

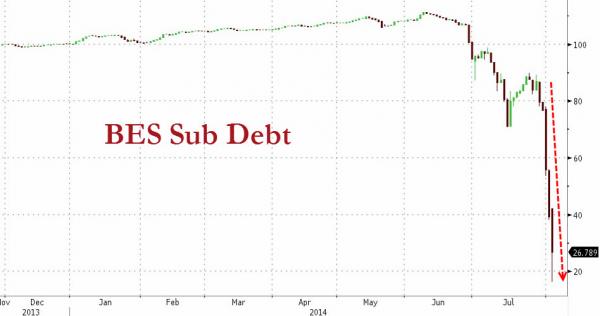

Rather than continue to bemoan modern portfolio theory, I’d rather focus on how this shift in asset allocation will create opportunities. No chart better illustrates this than the performance of Banco Espirito Santo 2023 subordinated debt:

Does anyone not know that European banks have issues (remember this was 2 years ago)? Does anyone actually believe that the European financial crisis is “solved?”

Any proper perusal of the financial statements would tell you that many European banks have “issues.”

Banco Espirito Santo didn’t suddenly have a problem — it has been troubled for a very long time. The difference is that about four weeks ago, a payment at the parent company was missed and someone suddenly noticed that the problems mattered.

Look at the chart above—the sub debt traded over par, just 5 weeks ago!! That is what happens when the financial system is managed by indexers. They simply buy what they’re told to buy—they do no research. If it is in the index, they need to own it, and we all know that bonds have been a very hot product with lots of inflows over the past few years.

How do you make money off of this? The key is research and knowledge. The good news is that all sorts of assets are mispriced. In the past, these would be mispriced because humans made mistakes in valuing them. Now they’re mispriced because they are part of a big index and some computer keeps buying them—creating a situation of overvaluation. Or they aren’t yet part of the index and no one knows they exist.

An 80% gain in a month from having realized that a debt payment at a parent company would be missed, is a huge gain. There are more gains like this out there.

Chris again...

My question for today:

Cast your vote here and also see what others think

Cast your vote here and also see what others thinkBottom line: there is no such thing as passive investing. It's like passive sex. How it works I've no idea. But I just know that it doesn't.

- Chris

“I own last year’s top performing funds. Unfortunately, I bought them this year.” — Anonymous

Liked this article? Don't miss our future missives and podcasts, and

get access to free subscriber-only content here.

--------------------------------------

via Motley Fool Headlines by on Sun, 15 Jan 2017 14:28:00 GMT

Disneyland begins offering a premium-priced platform to make ride reservations easier. Its larger resort on the East Coast may be taking notes.via Motley Fool Headlines by on Sun, 15 Jan 2017 14:24:00 GMT

If you sign up for more than you can afford, you'll be setting yourself up for disaster.via Motley Fool Headlines by on Sun, 15 Jan 2017 14:21:00 GMT

The self-driving car market is moving quickly. Read these facts so you don't get left behind.via Motley Fool Headlines by on Sun, 15 Jan 2017 14:13:00 GMT

Several companies offer weapons upgrades to give the little warship added "punch."via Motley Fool Headlines by on Sun, 15 Jan 2017 14:12:00 GMT

Studies like this can stomp out pot's progress.via by Tyler Durden on Sun, 15 Jan 2017 13:48:59 GMT

The simmering cold, if heating up with every passing day, war between Trump and the press may be about to turn conventional, with the occasional chance of an ICBM.

Just days after calling out CNN fake news during his first press conference of 2017, Esquire reports that according to three senior officials on the transition team, the incoming Trump administration is "seriously considering" a plan to evict the press corps from the White House.

If the plan goes through, one of the officials said, the media will be removed from the cozy confines of the White House press room, where it has worked for several decades. Members of the press will be relocated to the White House Conference Center—near Lafayette Square—or to a space in the Old Executive Office Building, next door to the White House.

Trump's press secretary tried to cast the possible relocation of the press corps as a matter, in part, of logistics. "There's been so much interest in covering a President Donald Trump," he said. "A question is: Is a room that has forty-nine seats adequate? When we had that press conference the other day, we had thousands of requests, and we capped it at four hundred. Is there an opportunity to potentially allow more members of the media to be part of this? That's something we're discussing."

He added that "There has been no decision," yet but acknowledged that "there has been some discussion about how to do it."

Other Trump staffers, however, explain that it's not business, it's personal. "They are the opposition party," a senior official was quoted by Esquire. "I want 'em out of the building. We are taking back the press room."

A brief history of the White House press room:

Reporters have had some sort of workspace at the White House since Teddy Roosevelt's time, but the current press room is an artifact of the Richard Nixon era, the dawn of the symbiosis of the press and the modern presidency. The "room" is actually a space containing work stations and broadcast booths, as well as the briefing area that is so familiar to viewers of presidential news conferences.

For the media, the White House press room—situated on the first floor, in the space between the presidential residence and the West Wing—is not only a convenience, with prime sources just steps away. It is also a symbol of the press' cherished role as representatives of the American people. In the midst of the George W. Bush presidency, when relations between reporters and the Administration were growing testy, the White House press corps was removed from the press room for nearly a year, while the facility was remodeled. The move prompted such concern that the president himself had to offer his assurance that it was only temporary. (As it happened, press conferences were held at the White House Conference Center during the renovation).

Ultimately, it boils down to what Esquire calls "the media's presumption of entitlement" which Trump officials "requires a change."

If there is a credo that reflects the culture inside the James Brady Briefing Room (named after President Ronald Reagan's first press secretary, who was wounded by a bullet meant for Reagan), it is that presidents come, and presidents go, but the White House press corps is forever. In that sentiment, some in the transition team discern precisely the attitude that led to the revolt that elected Trump president.

Whatever the philosophical consequences, a move of this magnitude by Trump would lead to even greater antagonism between the president and the press, which would likely lead to an even greater focus not so much on Trump's policies and proposals, as on Trump himself as the conflict between the president-elect and the press hurtles along toward some yet undetermined climax.

via Motley Fool Headlines by on Sun, 15 Jan 2017 13:52:00 GMT

The soft-drink giant has gone through some problems with its sugary carbonated beverages, but will that stop Coca-Cola from rewarding shareholders with higher dividends?via Motley Fool Headlines by on Sun, 15 Jan 2017 13:44:00 GMT

The average American consumer owes a little more than $5,000 on credit cards. If you're also deep in debt, here's what you can do.via Motley Fool Headlines by on Sun, 15 Jan 2017 13:44:00 GMT

The market hopes to keep posting gains this year after a solid 2016, but many aren't so sure.via Motley Fool Headlines by on Sun, 15 Jan 2017 13:21:00 GMT

American workers are contributing 6% to their workplace retirement plans, but the range of contribution rates varies widely depending workers income and age.via Motley Fool Headlines by on Sun, 15 Jan 2017 13:10:00 GMT

Listener Warren has to choose between a lump sum versus his defined benefit pension.via Motley Fool Headlines by on Sun, 15 Jan 2017 13:09:00 GMT

When it comes to retirement income, you can't put all your eggs into one basket. Social Security can be part of your financial picture, but you shouldn't bank on it entirely.via Motley Fool Headlines by on Sun, 15 Jan 2017 13:06:00 GMT

The Audi Q8 Concept is a preview of an upcoming new (and big) crossover SUV from the German brand. It also previews Audi's answer to the diesel mess.via Motley Fool Headlines by on Sun, 15 Jan 2017 13:03:00 GMT

Wells Fargo has done stock splits in the past, but some investors are nervous about its future.via Motley Fool Headlines by on Sun, 15 Jan 2017 12:51:00 GMT

It's not easy to pick a winner, but fresh wounds may make this brand the winner/loser.via Motley Fool Headlines by on Sun, 15 Jan 2017 12:43:00 GMT

The decision to start investing could be one of the smartest moves you ever make -- if you do it right.